Plus, it opens up your hiring options, because it helps your company hire better people from all over the country. In fact, around 29% of high-tech automation is to be found in accounting functions, while 22.8% https://www.business-accounting.net/ of businesses are looking to implement some form of automation in the coming years. It’s a back-end service provider to companies across various industries, from entertainment and hospitality to education.

Loss of control over accounting processes

The staff who previously managed these responsibilities will be free to work on new projects that help to grow the business, resulting in improved morale and productivity. This gives you more time to focus on your vision and purpose, enabling you to fulfill your core duties better. Keen attention to detail and robust knowledge for managing donations, funding, auditing, and financial reporting obligations are crucial. We do all the heavy lifting for you, giving you peace of mind and allowing you to focus your time, money, and resources on running and growing your business.

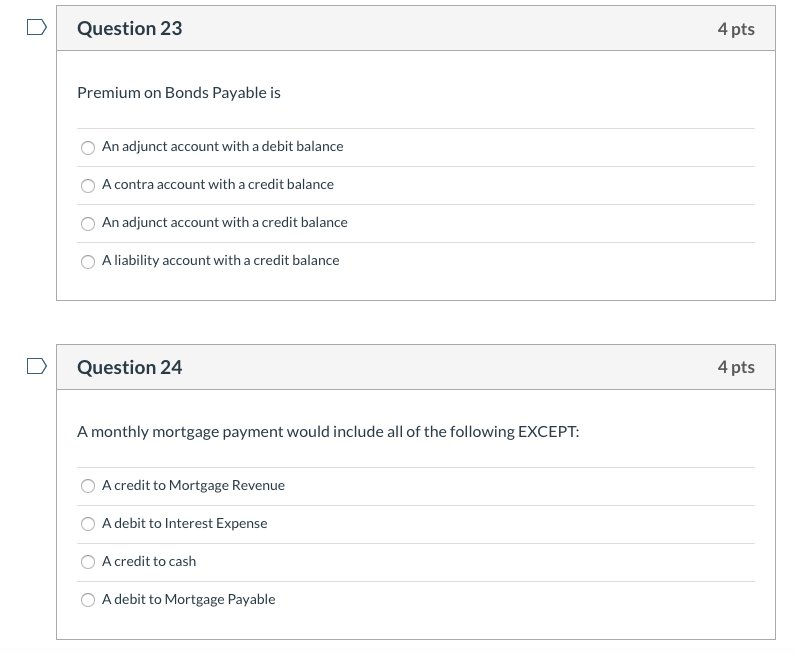

Outsourced Bookkeeping

Ignite Spot Accounting delivers heftier reports than many other cloud accounting providers we checked out for this piece. Along with typical financial reporting (like profit and loss reports and balance sheets), you’ll get a KPI (key performance indicator) report and profitability analysis, among others. You have to enter more information about your needs to get a quote—which is useful if you want truly customized services but unhelpful if you’d rather choose a basic plan out of a lineup.

Can outsourcing accounting services provide my business with 24/7 support and access to financial data?

For some companies, this time investment might outweigh the benefits and become a significant consideration in terms of both time and expenses. Managing financial accounts, from bookkeeping to financial reporting, to managing invoices remains a pivotal aspect of any business strategy. Yet, this task can be time-consuming and challenging, especially for SMBs lacking dedicated financial professionals.

- Today, the average salary for a bookkeeper in the U.S. is $45,160, the average controller earns $104,338, and the median CFO salary is $393,377.

- Since several companies are transitioning to a more hybrid or remote work model, outsourced accountants are much needed in smaller businesses and organizations.

- In partial outsourcing, a company hires an external provider to support and extend the in-house capabilities.

- In doing that, your outsourced accounting firm will work closely with you to develop an approach that works for your business.

- This will make sure you fulfil your legal requirements regarding taxes and will also ensure you have a good grasp on the overall financial health of your business at any given time.

Many outsourced accounting service providers offer completely bespoke packages to their clients. You’ll have the ability to add supplemental services as the needs of your business change. You might also see outsourced accounting referred to using terms when to capitalize vs expense payments made including Client Accounting Services (CAS) or fractional accounting. For the most part, these services are identical to outsourced accounting services, although it’s important to bear in mind that different providers will offer varying services.

They have a wide range of responsibilities, from managing bookkeeping staff to working on more strategic initiatives. But as your business grows and your financial needs evolve, it’s common to find that your initial approach to bookkeeping is no longer delivering the results you need. Companies outsource to achieve cost savings and focus on core business functions. Top-notch organizations opt to outsource to drive transformational business results. In this article, we’ll explain what exactly outsourced accounting is, what it covers, and how it can help your company. We’ll also give you some key tips and insights into finding a provider and ensuring the process goes smoothly.

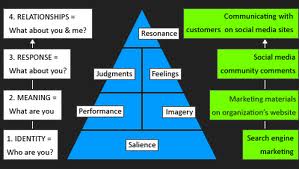

However, when it comes to accountancy, blockchains could be a serious gamechanger. Our survey also revealed some interesting stats on accounting technology and highlighted 11 more accounting trends you should be aware of. The four main trends our research has identified are the growth of blockchain, advancement of automation, spread of agile accounting and rise of more widespread third-party involvement.

Partnering with an outsourced controller gives businesses many of the same benefits as partnering with an outsourced bookkeeper, but on a more strategic level. Outsourced controllers are experienced accounting https://www.business-accounting.net/incidental-expenses-definition/ professionals who have worked with a diverse range of businesses. In doing that, your outsourced accounting firm will work closely with you to develop an approach that works for your business.

Outsourcing can help you easily keep your business running around the clock at a fraction of the cost. Non-core work is any activity that your business doesn’t necessarily specialize in. Andy is a technology & marketing leader who has delivered award-winning and world-first experiences.

Often, these third parties act almost as middlemen, helping to facilitate the sale or purchase of goods or services. Accounting automation technology will allow processes or procedures to be completed with minimal human assistance. When creating a list of evaluation criteria, remember to prioritize what matters most to your business.

These new technologies will create a marked improvement for efficiency and productivity, while also offering accountants a better balance between their domestic and work lives. Benefits of outsourcing include keeping your own headcount low, as well as a greater range of skillsets and tech knowledge than you would otherwise be able to access. Additional benefits include greater price certainty and boosted efficiency for all accountants, who can directly tie their work to the price they charge. By supporting diverse lifestyles, your company can retain talented staff even when their circumstances change. Childcare, for example, becomes far easier, as do the frequent doctor’s appointments needed for many of those impacted by chronic illness or disabilities. In simple terms, a third-party transaction is a sale or business transaction which involves the buyer, the seller, and another third party.

They can deal with legal compliance, employee wages, paying suppliers, managing expenses, and everything else, so you can focus on other aspects of running a company. This eliminates certain biases that could be harmful to your business moving forward. Would you rather tackle accounting yourself instead of outsourcing it to a third party?

We offer a suite of services that leverage leading technology platforms tailored to your own unique needs. First of all, building and managing in-house finance and accounting departments can be costly. From the hiring, onboarding, and training costs to salary and benefits to office space and equipment, you will have to spend thousands of dollars to handle your financial and accounting needs. But if you outsource the finance department, you won’t have to cover many of these costs. If your company has never utilized outsourcing as a resource before, you may have some questions that give you pause.

As you outsource these non-core activities, your in-house employee will have more time and resources to spend on the activities that you actually specialize in. Outsourcing is the process where a business delegates certain non-core business process activities to a third party. To help you out, this article will cover the biggest outsourcing companies in the world, their services, and how your business can benefit from them.

However, efforts made by small businesses and startups to secure this data are often inadequate and leave them prone to cyber-attacks and data thefts. With such lapses in business continuity, companies often run the risk of losing clients to a competitor. Typically, you’d only get detailed financial statements like this through a CFO — which means Merritt gives you some of the best aspects of having a CFO without the high cost. RSM employs a proven phased approach with continual validation checkpoints during the process, a dedicated team, regular meetings, end-user training and ongoing two-way communication. The entities falling under the Cherry Bekaert brand are independently owned and are not liable for the services provided by any other entity providing services under the Cherry Bekaert brand.